1. Recent Interest Rates will Become the Norm

You might be shocked to hear that 30 Year Mortgage Rates are not inflated. Despite what the news coverage says about the rates, they aren’t as high as you expect. January of 2019, the 30 year fixed rate was at 5.04% according to Mortgage News Daily. As of April 29th, 2022 the 30 year fixed rate is at 5.17% also according to Mortgage News Daily. Since the 1980s, the average 30 year mortgage rate has been a little higher than 5% As homeowners we have been spoiled by low interest rates. Not to fear because in the near future interest rates will continue to go lower.

2. Inflation is Transitory

If you are interested in buying a house then do not let the mortgage rates deter you. Higher rates are a byproduct of inflation, and the Federal Reserve will continue to increase the mortgage rates as inflation increases. The Federal Reserve printed out over $1.4 trillion (Yes, with a T) and that will deteriorate the value of the US Dollar. If are looking to buy a house now, but don’t want to pay the high mortgage rates then you have to live with the fact that interest rates will continue to climb until 8-10% As someone who has a Minor in Economics at Rutgers, I understand how interest rates will behave in the future.

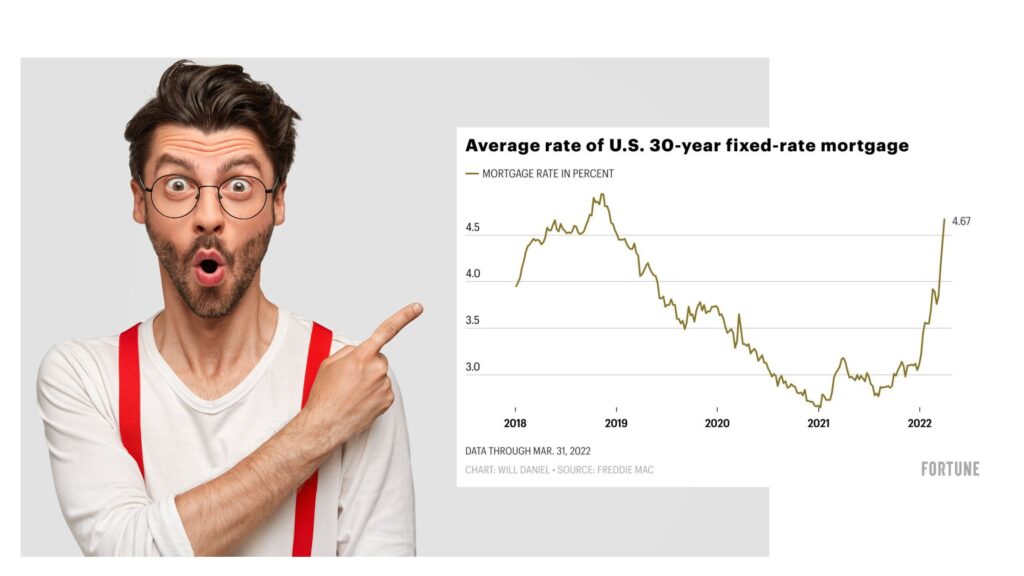

3. Historical Average is Greater than 5%

Here is a 5 year chart of the 30 year mortgage interest rate, and as you can see that not long ago homebuyers were paying 5% interest rates. Things get interesting when people find out that they can refinance their house two to three years down the line. No matter how high the mortgage interest rates are there will be a time when you can refinance to a lower rate. Home buyers in July of 2018 approximately paid 4.8% for their 30Y mortgage; however, within the next 5 to 6 months rates will decrease. There were more refinances than anything in the world, and that is why homeowners currently have a 3.8% 30Y rate. Down the line you can also refinance your loan, and it will pay multiple.

4. Home Prices will Continue to Increase as Inventory Decreases

I currently reside in New Jersey, and within NJ there are no signs of newly built houses. This is an issue that we see all across the country. Towns are not allowing new single family homes to be built. They want construction around new town squares and commercial properties. There are towns that allow for new constructions of single family homes, but those houses will not be finished until 2025. As someone who has been a part of the industry, I also learned that you cannot guess the price of homes. If you want to move to a single family home, then move. Do not let the interest rates deter you.

5. Borrowers will not Hold on to the Mortgage Loan Longer than 5 Years

Most homeowners will not pay for the loan for the 30 years lifespan. On average, the lifespan of a conventional loan is a little under 10 years. This is not because the borrower will pay off the mortgage in 9 years, but because they will refinance their home. Or, the borrower will go on to refinance the home for a lower interest rate. Borrowers can also go on to purchase a new home before the loan is paid out. On average, the homeowner only stays in the home they purchase for 15 years. There is a likely chance that you will not stay in the house, so why worry about the interest rate?

Here is what does matter: Loan Officer

If you don’t have a trustworthy or intelligent loan officer that you can rely on, then it is game over. As a borrower, your loan officer must be data-driven who keeps in touch with you all along the way. This is going to be the largest loan of your life, and someone should be there to hold your hand. A loan officer also should be focused on your needs. Not all borrowers have the same exact needs. Some borrowers are forgetful and other borrowers are quick to everything. As a loan officer you must take all the information to account, and represent your client in the best way possible. Accommodation is one of the most important characteristics for a loan officer.

Need a Mortgage?

Call: (908)-227-1327

Email: Dev@homegotowned.com